As a taxpayer in the Philippines, it's essential to understand the various forms and requirements that come with filing your taxes. One of the most important forms you'll need to familiarize yourself with is the Bir Form 0605. In this article, we'll delve into the world of Bir Form 0605, exploring its purpose, requirements, and steps to follow for a seamless tax filing experience.

Understanding Bir Form 0605

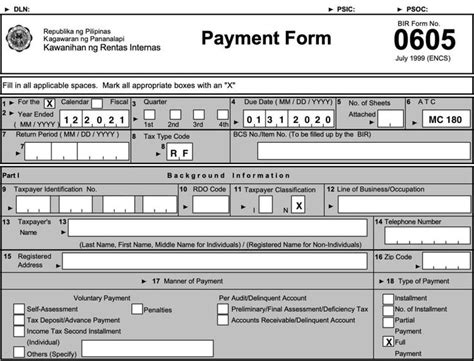

Bir Form 0605 is a tax form used by the Bureau of Internal Revenue (BIR) to collect tax payments from individuals and businesses. It's a crucial document that ensures taxpayers comply with their tax obligations and provides the BIR with necessary information to process tax payments.

Purpose of Bir Form 0605

The primary purpose of Bir Form 0605 is to facilitate the payment of taxes, including:

- Income tax

- Value-added tax (VAT)

- Withholding tax

- Documentary stamp tax

- Other taxes and fees

By submitting Bir Form 0605, taxpayers can settle their tax liabilities and avoid any penalties or fines associated with late or non-payment of taxes.

Requirements for Filing Bir Form 0605

To file Bir Form 0605, taxpayers must meet the following requirements:

- Register with the BIR and obtain a Taxpayer Identification Number (TIN)

- Prepare and submit the required tax returns and attachments

- Pay the corresponding tax due

- Comply with the prescribed payment schedules and deadlines

Steps to Follow for Filing Bir Form 0605

Filing Bir Form 0605 involves several steps:

- Gather required documents: Collect all necessary documents, including tax returns, receipts, and certificates of registration.

- Fill out the form: Accurately fill out Bir Form 0605, ensuring all required information is provided.

- Attach supporting documents: Attach all supporting documents, including tax returns and receipts.

- Pay the tax due: Pay the corresponding tax due, either through online banking, over-the-counter, or through authorized payment centers.

- Submit the form: Submit the completed form and attached documents to the BIR office or authorized agent.

Benefits of Filing Bir Form 0605

Filing Bir Form 0605 offers several benefits, including:

- Avoidance of penalties: Timely payment of taxes avoids penalties and fines.

- Compliance with tax laws: Filing Bir Form 0605 ensures compliance with tax laws and regulations.

- Accurate tax records: Maintaining accurate tax records helps taxpayers track their tax payments and obligations.

Common Mistakes to Avoid

When filing Bir Form 0605, taxpayers should avoid the following common mistakes:

- Inaccurate or incomplete information: Ensure all information is accurate and complete to avoid delays or rejection of the form.

- Late or non-payment of taxes: Pay taxes on time to avoid penalties and fines.

- Failure to attach supporting documents: Attach all required supporting documents to avoid delays or rejection of the form.

Tips for Smooth Tax Filing

To ensure a smooth tax filing experience, taxpayers should:

- Keep accurate records: Maintain accurate and up-to-date tax records.

- Consult with a tax professional: Consult with a tax professional or accountant to ensure compliance with tax laws and regulations.

- File taxes on time: File taxes on time to avoid penalties and fines.

Conclusion

Filing Bir Form 0605 is a crucial step in complying with tax laws and regulations in the Philippines. By understanding the purpose, requirements, and steps involved in filing this form, taxpayers can ensure a seamless tax filing experience. Remember to avoid common mistakes, keep accurate records, and consult with a tax professional to ensure compliance with tax laws and regulations.

Frequently Asked Questions

What is Bir Form 0605?

+Bir Form 0605 is a tax form used by the Bureau of Internal Revenue (BIR) to collect tax payments from individuals and businesses.

What are the requirements for filing Bir Form 0605?

+Requirements for filing Bir Form 0605 include registering with the BIR, preparing and submitting required tax returns and attachments, paying the corresponding tax due, and complying with prescribed payment schedules and deadlines.

What are the benefits of filing Bir Form 0605?

+The benefits of filing Bir Form 0605 include avoidance of penalties, compliance with tax laws, and accurate tax records.