Arizona residents who receive retirement income may be subject to state income tax withholding. To manage their tax liability, individuals can elect to change their withholding percentage using Arizona Form 285. This guide will walk you through the process of completing Form 285, understanding the implications of changing your withholding percentage, and providing tips on how to minimize your tax burden.

What is Arizona Form 285?

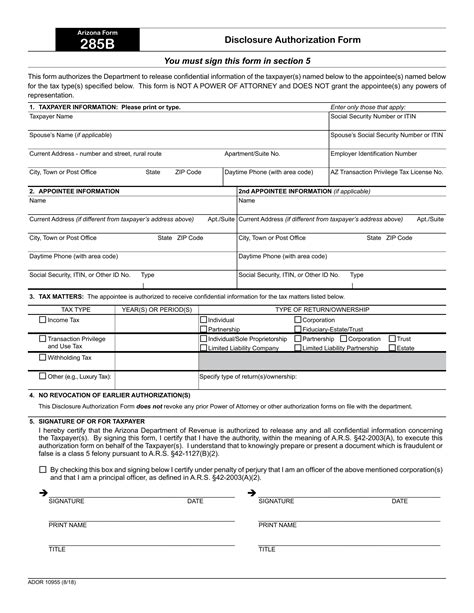

Arizona Form 285, also known as the Withholding Percentage Election, is a tax form used by Arizona residents to elect a different withholding percentage for their retirement income. The form allows individuals to adjust their withholding percentage to better align with their tax obligations, reducing the likelihood of underpayment or overpayment of taxes.

Why is it important to review and adjust your withholding percentage?

Reviewing and adjusting your withholding percentage is crucial to ensure you are not overpaying or underpaying your taxes. If you are withholding too much, you may be giving the state an interest-free loan, which could be better utilized for your financial needs. On the other hand, if you are withholding too little, you may face penalties and interest on underpaid taxes. By completing Form 285, you can adjust your withholding percentage to minimize your tax liability and avoid potential penalties.

How to complete Arizona Form 285

Completing Arizona Form 285 is a relatively straightforward process. Here's a step-by-step guide to help you through it:

- Gather necessary information: Before starting the form, ensure you have the following information:

- Your name and address

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your retirement account information (e.g., account number, plan name)

- Choose your withholding percentage: Decide on the new withholding percentage you want to elect. You can choose from the following options:

- 0% (no withholding)

- 2% (standard withholding rate)

- 4% (increased withholding rate)

- 6% (maximum withholding rate)

- Complete Section 1: Fill in your name, address, and Social Security number or ITIN.

- Complete Section 2: Provide your retirement account information, including the account number and plan name.

- Complete Section 3: Elect your new withholding percentage by checking the corresponding box.

- Sign and date the form: Sign and date the form to confirm your election.

Submission and processing

Once you've completed Form 285, submit it to the Arizona Department of Revenue or your retirement plan administrator. The processing time may vary depending on the submission method and the workload of the processing agency.

Submission methods:

- Mail: Arizona Department of Revenue, PO Box 29085, Phoenix, AZ 85038-9085

- Fax: (602) 255-3381

- Online: through the Arizona Department of Revenue's website

Tips to minimize your tax burden

While completing Form 285 is an essential step in managing your tax liability, there are additional strategies to consider:

- Consult a tax professional: Seek advice from a qualified tax professional to ensure you're making the most tax-efficient decisions.

- Review your tax obligations: Regularly review your tax obligations to ensure you're not overpaying or underpaying taxes.

- Take advantage of tax credits: Claim tax credits you're eligible for, such as the Arizona Charitable Tax Credit.

- Consider tax-deferred accounts: Utilize tax-deferred accounts, such as 401(k) or IRA, to minimize your tax liability.

FAQs

What is the standard withholding rate for Arizona state income tax?

+The standard withholding rate for Arizona state income tax is 2%.

Can I change my withholding percentage multiple times?

+Is there a deadline for submitting Form 285?

+No, there is no specific deadline for submitting Form 285. However, it's recommended to submit the form as soon as possible to ensure your new withholding percentage takes effect promptly.

We hope this comprehensive guide to Arizona Form 285 has provided you with the necessary information to manage your tax liability effectively. If you have any further questions or concerns, please don't hesitate to reach out to a tax professional or the Arizona Department of Revenue.