As the Grand Canyon State, Arizona is renowned for its breathtaking natural beauty and pleasant climate. However, when it comes to taxation, residents and non-residents alike often find themselves navigating a complex web of forms and regulations. One such form that frequently raises questions is the Arizona Form 140PTC. In this article, we will delve into the specifics of this form, exploring its purpose, eligibility criteria, and the benefits it offers.

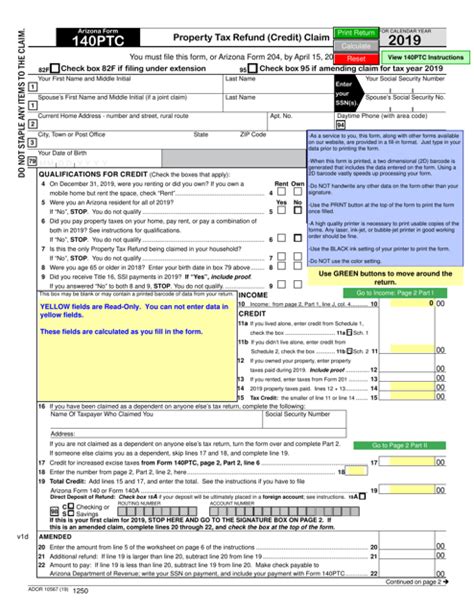

Arizona Form 140PTC, also known as the Property Tax Refund (Credit) Claim, is a vital document for Arizona taxpayers who own or rent a primary residence within the state. The form serves as a means to claim a refund or credit for property taxes paid on this primary residence. To better understand the intricacies of Form 140PTC, let's examine five key aspects that every Arizona taxpayer should be aware of.

What is Arizona Form 140PTC?

Arizona Form 140PTC is a tax form issued by the Arizona Department of Revenue, designed to help eligible taxpayers recoup a portion of the property taxes they've paid on their primary residence. This form is part of the Arizona Property Tax Refund (Credit) program, which aims to provide relief to low-income families, seniors, and individuals with disabilities.

Eligibility Criteria

To qualify for the Property Tax Refund (Credit), taxpayers must meet specific eligibility requirements:

- The taxpayer must have been an Arizona resident for the entire tax year.

- The taxpayer must have owned or rented a primary residence in Arizona for the entire tax year.

- The taxpayer's total household income must not exceed a certain threshold, which varies annually.

- The taxpayer must not have received a property tax exemption or rebate for the same tax year.

How to Claim the Property Tax Refund (Credit)

Claiming the Property Tax Refund (Credit) involves several steps:

- Obtain Form 140PTC from the Arizona Department of Revenue website or contact the department directly to request a paper copy.

- Complete the form accurately, ensuring all required information is provided.

- Attach supporting documentation, such as proof of residency and property tax payments.

- Submit the completed form and supporting documents to the Arizona Department of Revenue by the designated deadline.

Benefits of the Property Tax Refund (Credit)

The Property Tax Refund (Credit) offers several benefits to eligible Arizona taxpayers:

- Relief from property tax burden: The refund or credit can help alleviate some of the financial strain associated with property taxes.

- Increased disposable income: By reducing property tax liability, taxpayers may enjoy more disposable income for other essential expenses.

- Simplified tax filing process: The Arizona Department of Revenue provides a dedicated form and clear guidelines, making it easier for taxpayers to claim the refund or credit.

Common Mistakes to Avoid

When completing Form 140PTC, taxpayers should be mindful of common mistakes that could lead to delays or rejection:

- Inaccurate or incomplete information

- Failure to attach required supporting documentation

- Missing deadlines for submission

Conclusion

Arizona Form 140PTC serves as a vital resource for eligible taxpayers seeking to alleviate their property tax burden. By understanding the form's purpose, eligibility criteria, and benefits, taxpayers can navigate the process with confidence. As the tax landscape continues to evolve, staying informed about available refund and credit opportunities can help Arizona residents optimize their tax strategy.

We hope this comprehensive guide has provided valuable insights into the Arizona Form 140PTC. Whether you're a seasoned taxpayer or new to the state, understanding the intricacies of this form can help you make the most of your hard-earned money. Share your thoughts and experiences with Form 140PTC in the comments below, and don't hesitate to reach out if you have any further questions or concerns.

What is the deadline for submitting Arizona Form 140PTC?

+The deadline for submitting Arizona Form 140PTC typically falls on April 15th of each year. However, it's essential to verify the deadline with the Arizona Department of Revenue, as it may be subject to change.

Can I claim the Property Tax Refund (Credit) if I rent my primary residence?

+Yes, renters may be eligible for the Property Tax Refund (Credit) if they meet the necessary criteria, including having a primary residence in Arizona and meeting the income threshold.

How do I obtain a copy of Arizona Form 140PTC?

+Arizona Form 140PTC can be obtained from the Arizona Department of Revenue website or by contacting the department directly to request a paper copy.