The amendatory clause is a crucial component of the FHA form approval process, and its benefits cannot be overstated. As a crucial part of the mortgage process, understanding how the amendatory clause works can make a significant difference in the success of your FHA form approval. In this article, we will delve into the world of FHA form approval and explore the five ways the amendatory clause can boost your chances of approval.

What is an Amendatory Clause?

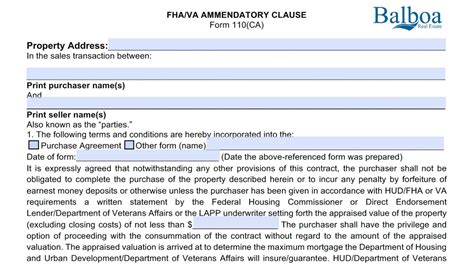

Before we dive into the benefits of the amendatory clause, let's first define what it is. An amendatory clause is a provision in a contract or agreement that allows for changes or modifications to be made to the original terms. In the context of FHA form approval, the amendatory clause is a critical component of the mortgage process that enables lenders to make adjustments to the loan terms after the initial application has been submitted.

1. Flexibility in Loan Terms

One of the primary benefits of the amendatory clause is that it provides flexibility in loan terms. This means that if the borrower's financial situation changes or if the lender requires additional information, the amendatory clause allows for adjustments to be made to the loan terms without having to restart the entire application process. This flexibility can be a significant advantage for borrowers who may have changing financial circumstances or for lenders who need to adjust the loan terms to meet regulatory requirements.

How Flexibility in Loan Terms Benefits Borrowers

- Allows for changes to be made to the loan terms without having to restart the application process

- Provides flexibility for borrowers with changing financial circumstances

- Enables lenders to adjust loan terms to meet regulatory requirements

2. Reduced Risk for Lenders

The amendatory clause also reduces the risk for lenders by allowing them to make adjustments to the loan terms after the initial application has been submitted. This can be particularly beneficial for lenders who may have concerns about the borrower's creditworthiness or who need to adjust the loan terms to meet regulatory requirements. By including an amendatory clause in the loan agreement, lenders can reduce their risk and ensure that the loan terms are fair and reasonable.

How Reduced Risk for Lenders Benefits Borrowers

- Reduces the risk of loan rejection due to lender concerns about creditworthiness

- Enables lenders to adjust loan terms to meet regulatory requirements

- Provides a safer and more stable lending environment for borrowers

3. Streamlined Approval Process

The amendatory clause can also streamline the approval process by allowing lenders to make adjustments to the loan terms without having to restart the entire application process. This can save time and reduce the administrative burden on lenders, which can ultimately benefit borrowers by reducing the time it takes to approve the loan.

How a Streamlined Approval Process Benefits Borrowers

- Reduces the time it takes to approve the loan

- Saves time and reduces the administrative burden on lenders

- Provides a more efficient and effective lending process

4. Improved Communication Between Lenders and Borrowers

The amendatory clause can also improve communication between lenders and borrowers by providing a clear and transparent framework for making adjustments to the loan terms. This can help to build trust and confidence between lenders and borrowers, which is essential for a successful lending relationship.

How Improved Communication Benefits Borrowers

- Provides a clear and transparent framework for making adjustments to the loan terms

- Builds trust and confidence between lenders and borrowers

- Enables lenders and borrowers to work together to find solutions to any issues that may arise

5. Increased Flexibility in Loan Options

Finally, the amendatory clause can provide increased flexibility in loan options by allowing lenders to offer a wider range of loan products and terms. This can benefit borrowers by providing them with more choices and flexibility when it comes to selecting a loan that meets their needs.

How Increased Flexibility in Loan Options Benefits Borrowers

- Provides a wider range of loan products and terms

- Offers borrowers more choices and flexibility when selecting a loan

- Enables lenders to tailor loan products to meet the specific needs of borrowers

In conclusion, the amendatory clause is a critical component of the FHA form approval process that provides numerous benefits for both lenders and borrowers. By including an amendatory clause in the loan agreement, lenders can reduce their risk, streamline the approval process, and provide more flexibility in loan options. Borrowers can also benefit from the amendatory clause by having more flexibility in loan terms, reduced risk of loan rejection, and improved communication with lenders.

We hope this article has provided you with a comprehensive understanding of the amendatory clause and its benefits. If you have any questions or comments, please feel free to share them with us.

What is an amendatory clause?

+An amendatory clause is a provision in a contract or agreement that allows for changes or modifications to be made to the original terms.

How does the amendatory clause benefit lenders?

+The amendatory clause reduces the risk for lenders by allowing them to make adjustments to the loan terms after the initial application has been submitted.

How does the amendatory clause benefit borrowers?

+The amendatory clause provides flexibility in loan terms, reduces the risk of loan rejection, and improves communication with lenders.