Completing an AARP supplemental insurance application can seem daunting, but breaking it down into manageable steps makes the process much more straightforward. AARP supplemental insurance is designed to help cover the gaps in Original Medicare, providing financial protection against unexpected medical expenses. By following these five steps, you'll be well on your way to securing the coverage you need.

Step 1: Determine Your Eligibility and Choose Your Plan

Before starting the application process, it's essential to confirm your eligibility for AARP supplemental insurance. Typically, you must be 65 or older, enrolled in Medicare Parts A and B, and a resident of the state where the policy is offered. AARP offers several plans, each with varying levels of coverage and premiums. Take the time to research and compare the different plans to determine which one best suits your needs and budget.

Understanding AARP Supplemental Insurance Plans

AARP offers a range of supplemental insurance plans, including:

- Plan A: Basic coverage with lower premiums

- Plan F: Comprehensive coverage with higher premiums

- Plan G: High-deductible plan with lower premiums

- Plan K: Cost-sharing plan with lower premiums

- Plan L: Cost-sharing plan with lower premiums

Each plan has its unique features, benefits, and limitations. Carefully review the plans to ensure you choose the one that best fits your needs.

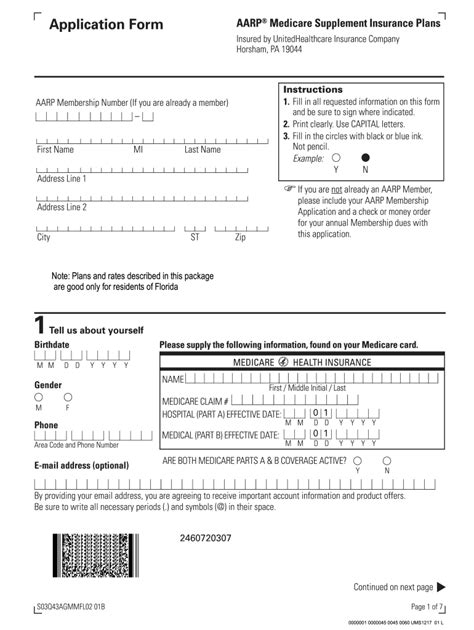

Step 2: Gather Required Documents and Information

To complete the application, you'll need to provide personal and medical information. Gather the following documents and information:

- Medicare card (Parts A and B)

- Proof of age (birth certificate or passport)

- Proof of residency (driver's license or utility bill)

- Social Security number

- Health history, including any pre-existing conditions

- List of medications and dosages

- Information about your current health insurance coverage

Having all the required documents and information readily available will streamline the application process.

Step 3: Complete the Application

Once you've gathered all the necessary information, it's time to complete the application. You can apply online, by phone, or through the mail. Be sure to answer all questions accurately and thoroughly. If you're unsure about any part of the application, consider consulting with a licensed insurance agent or broker.

Tips for Completing the Application:

- Read the application carefully and answer all questions truthfully.

- Make sure to sign and date the application.

- If you're applying online, be sure to save your progress and submit the application securely.

Step 4: Review and Submit the Application

Before submitting the application, review it carefully to ensure accuracy and completeness. Check for any errors or omissions, and make any necessary corrections. Once you're satisfied with the application, submit it according to the instructions provided.

Step 5: Follow Up and Receive Your Policy

After submitting your application, AARP will review it and verify the information provided. If approved, you'll receive your policy documents, including your insurance card and policy terms. Carefully review the policy to ensure it meets your expectations.

By following these five steps, you'll be able to complete your AARP supplemental insurance application with confidence. Remember to carefully review your policy and ask any questions you may have to ensure you have the coverage you need.

We encourage you to share your experiences with AARP supplemental insurance in the comments below. Have you recently applied for coverage? What was your experience like? Share your story to help others make informed decisions about their health insurance needs.

What is AARP supplemental insurance?

+AARP supplemental insurance is a type of insurance designed to help cover the gaps in Original Medicare, providing financial protection against unexpected medical expenses.

How do I determine my eligibility for AARP supplemental insurance?

+To be eligible for AARP supplemental insurance, you must be 65 or older, enrolled in Medicare Parts A and B, and a resident of the state where the policy is offered.

What documents do I need to apply for AARP supplemental insurance?

+You'll need to provide personal and medical information, including your Medicare card, proof of age, proof of residency, Social Security number, health history, and list of medications and dosages.