The payroll department is a critical component of any organization, responsible for ensuring that employees are paid accurately and on time. However, managing payroll can be a complex and time-consuming process, particularly when dealing with multiple pay periods, varying pay rates, and numerous deductions. This is where Purchase Orders (PO) forms come in – a crucial tool that can significantly impact payroll departments. In this article, we will explore five ways PO forms can affect payroll departments.

What are PO Forms?

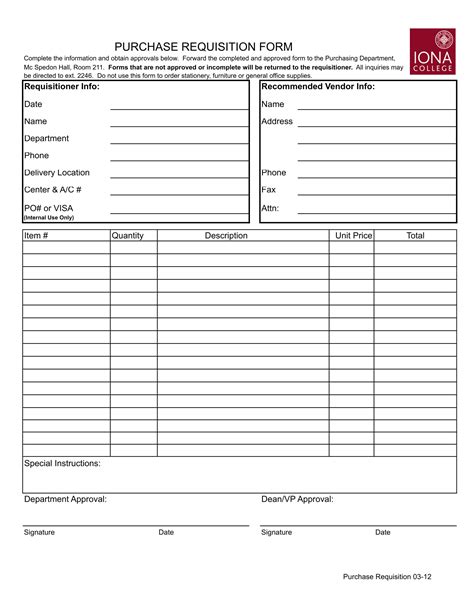

PO forms are documents used by organizations to authorize and track purchases made from external vendors or suppliers. They typically include details such as the items being purchased, quantities, prices, and payment terms. In the context of payroll, PO forms can be used to manage and track employee expenses, travel reimbursements, and other work-related expenditures.

Impact on Payroll Departments

PO forms can have a significant impact on payroll departments in several ways:

1. Improved Expense Tracking and Management

PO forms enable payroll departments to track and manage employee expenses more efficiently. By using PO forms to authorize and track purchases, payroll staff can ensure that expenses are accurately recorded and accounted for. This helps to prevent errors, misallocations, and potential discrepancies in employee reimbursements.

2. Enhanced Audit Trails and Compliance

PO forms provide a clear audit trail, which is essential for maintaining compliance with financial regulations and internal policies. By using PO forms to document and track transactions, payroll departments can demonstrate transparency and accountability, reducing the risk of errors, misstatements, or potential fraud.

3. Streamlined Reimbursement Processes

PO forms can streamline reimbursement processes by providing a standardized and efficient way to manage employee expenses. By using PO forms to track and verify expenses, payroll staff can quickly process reimbursements, reducing the time and effort required to complete this task.

4. Better Budgeting and Forecasting

PO forms can help payroll departments improve budgeting and forecasting by providing real-time data on employee expenses. By analyzing PO form data, payroll staff can identify trends, patterns, and areas for cost savings, enabling them to make more informed budgeting and forecasting decisions.

5. Reduced Errors and Discrepancies

PO forms can help reduce errors and discrepancies in payroll processing by providing a clear and standardized way to track and manage employee expenses. By using PO forms to verify and authorize transactions, payroll staff can minimize the risk of errors, misallocations, and potential disputes.

Implementing PO Forms in Payroll Departments

Implementing PO forms in payroll departments requires careful planning and consideration. Here are some key steps to follow:

- Define the scope and purpose of PO forms in your payroll department

- Develop a standardized PO form template that includes all necessary fields and information

- Establish clear policies and procedures for using PO forms

- Train payroll staff on the use and benefits of PO forms

- Monitor and review PO form usage to ensure compliance and effectiveness

Best Practices for Using PO Forms in Payroll Departments

To get the most out of PO forms in your payroll department, follow these best practices:

- Use a standardized PO form template to ensure consistency and accuracy

- Ensure that all PO forms are properly authorized and approved before use

- Use PO forms to track and manage all employee expenses, including travel reimbursements and other work-related expenditures

- Regularly review and audit PO form usage to ensure compliance and effectiveness

- Consider implementing automated PO form processing and approval systems to streamline workflows and reduce errors

By implementing PO forms and following best practices, payroll departments can improve expense tracking and management, enhance audit trails and compliance, streamline reimbursement processes, improve budgeting and forecasting, and reduce errors and discrepancies.

We hope this article has provided valuable insights into the impact of PO forms on payroll departments. If you have any questions or comments, please feel free to share them below.

What is the purpose of PO forms in payroll departments?

+PO forms are used to authorize and track employee expenses, travel reimbursements, and other work-related expenditures.

How can PO forms improve expense tracking and management?

+PO forms enable payroll departments to track and manage employee expenses more efficiently, reducing errors, misallocations, and potential discrepancies.

What are some best practices for using PO forms in payroll departments?

+Best practices include using a standardized PO form template, ensuring proper authorization and approval, tracking and managing all employee expenses, and regularly reviewing and auditing PO form usage.