Filing 8615 Form: A Step-By-Step Instruction Guide

As a minor with investment income, it's essential to understand the tax implications and how to report it to the IRS. The IRS Form 8615 is used to report the income and calculate the tax liability for minors with investment income. In this article, we will provide a step-by-step guide on how to file the 8615 Form correctly.

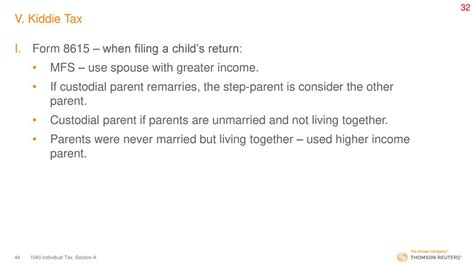

Minors with investment income, such as interest, dividends, or capital gains, are required to file the 8615 Form to report their income and calculate their tax liability. The form is used to calculate the "kiddie tax," which is the tax on the minor's unearned income. The kiddie tax is designed to prevent parents from shifting their income to their children to avoid paying taxes.

Who Needs to File the 8615 Form?

The 8615 Form is required for minors who have investment income exceeding $2,200 in a tax year. This includes income from:

- Interest from savings accounts or bonds

- Dividends from stocks

- Capital gains from the sale of investments

- Income from trusts or estates

Minors who are required to file the 8615 Form include:

- Children under the age of 18

- Children under the age of 24 who are full-time students

- Children who are permanently disabled

Step 1: Gather Required Documents

To file the 8615 Form, you will need the following documents:

- The minor's investment statements

- The minor's tax return (Form 1040)

- The parent's tax return (Form 1040)

- Any other relevant tax documents

Step 2: Calculate the Minor's Investment Income

Calculate the minor's investment income by adding up the income from all sources, including:

- Interest from savings accounts or bonds

- Dividends from stocks

- Capital gains from the sale of investments

- Income from trusts or estates

Step 3: Calculate the Kiddie Tax

Calculate the kiddie tax by multiplying the minor's investment income by the parent's tax rate. The kiddie tax is calculated as follows:

- If the minor's investment income is $2,200 or less, no tax is owed.

- If the minor's investment income is between $2,201 and $12,000, the tax is calculated at the parent's tax rate.

- If the minor's investment income is above $12,000, the tax is calculated at the trust tax rate.

Completing the 8615 Form

To complete the 8615 Form, follow these steps:

- Enter the minor's name and social security number at the top of the form.

- Enter the minor's investment income on Line 1.

- Calculate the kiddie tax on Line 2.

- Enter the parent's tax rate on Line 3.

- Calculate the tax liability on Line 4.

- Sign and date the form.

Filing the 8615 Form

The 8615 Form must be filed with the minor's tax return (Form 1040). If the minor is not required to file a tax return, the 8615 Form must be filed with the parent's tax return (Form 1040).

Common Mistakes to Avoid

Common mistakes to avoid when filing the 8615 Form include:

- Failing to report all investment income

- Failing to calculate the kiddie tax correctly

- Failing to sign and date the form

- Failing to file the form with the correct tax return

By following the steps outlined in this article, you can ensure that you file the 8615 Form correctly and avoid any potential penalties or fines. If you are unsure about any part of the process, it's always best to consult with a tax professional.

Conclusion

Filing the 8615 Form is an essential part of reporting investment income for minors. By following the steps outlined in this article, you can ensure that you file the form correctly and avoid any potential penalties or fines. Remember to gather all required documents, calculate the minor's investment income, calculate the kiddie tax, complete the 8615 Form, and file it with the correct tax return.

We hope this article has been informative and helpful. If you have any questions or comments, please feel free to share them with us.

What is the purpose of the 8615 Form?

+The 8615 Form is used to report the income and calculate the tax liability for minors with investment income.

Who needs to file the 8615 Form?

+The 8615 Form is required for minors who have investment income exceeding $2,200 in a tax year.

How do I calculate the kiddie tax?

+The kiddie tax is calculated by multiplying the minor's investment income by the parent's tax rate.