The 4506-C form is a crucial document used by lenders, creditors, and government agencies to verify an individual's or business's income and employment history. Despite its importance, many people are unaware of the purpose and benefits of this form. In this article, we will delve into the world of the 4506-C form, exploring its significance, advantages, and how it can impact your financial transactions.

What is the 4506-C Form?

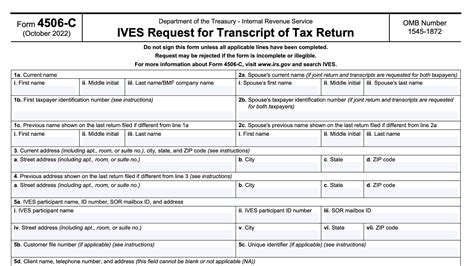

The 4506-C form, also known as the IVES Request for Transcript of Tax Return, is a document used to request a transcript of an individual's or business's tax return from the Internal Revenue Service (IRS). The form is typically used by lenders, creditors, and government agencies to verify an applicant's income and employment history. The information obtained from the transcript is used to determine the applicant's creditworthiness and ability to repay loans or debts.

Purpose of the 4506-C Form

Purpose of the 4506-C Form

The primary purpose of the 4506-C form is to provide a standardized method for requesting and obtaining tax return transcripts from the IRS. The form is used in various situations, including:

- Mortgage applications: Lenders use the 4506-C form to verify an applicant's income and employment history before approving a mortgage loan.

- Credit applications: Creditors use the form to assess an applicant's creditworthiness and determine their ability to repay debts.

- Government benefits: Government agencies use the form to verify an individual's income and employment history before approving benefits such as social security or unemployment benefits.

- Business loans: Lenders use the form to verify a business's income and employment history before approving a loan.

Benefits of the 4506-C Form

Benefits of the 4506-C Form

The 4506-C form provides several benefits to both individuals and organizations. Some of the key advantages include:

- Verification of income: The form provides a standardized method for verifying an individual's or business's income and employment history.

- Creditworthiness assessment: The information obtained from the transcript helps lenders and creditors assess an applicant's creditworthiness and ability to repay debts.

- Reduced risk: By verifying an applicant's income and employment history, lenders and creditors can reduce the risk of lending or providing credit.

- Streamlined process: The 4506-C form provides a streamlined process for requesting and obtaining tax return transcripts, reducing the administrative burden on lenders, creditors, and government agencies.

How to Complete the 4506-C Form

How to Complete the 4506-C Form

Completing the 4506-C form is a straightforward process that requires basic information about the individual or business requesting the transcript. The form must be signed and dated by the individual or business, and it must include the following information:

- Name and address: The name and address of the individual or business requesting the transcript.

- Social Security number or Employer Identification Number (EIN): The Social Security number or EIN of the individual or business requesting the transcript.

- Tax year: The tax year for which the transcript is being requested.

- Type of transcript: The type of transcript being requested (e.g., individual, business, or both).

Common Challenges and Solutions

Common Challenges and Solutions

Despite the importance of the 4506-C form, many individuals and businesses encounter challenges when completing the form or requesting a transcript. Some common challenges and solutions include:

- Incorrect information: Ensure that the information provided on the form is accurate and complete.

- Incomplete form: Ensure that the form is fully completed and signed before submitting it to the IRS.

- Delayed transcript: Allow sufficient time for the IRS to process the request and provide the transcript.

Best Practices for Using the 4506-C Form

Best Practices for Using the 4506-C Form

To ensure that the 4506-C form is used effectively, follow these best practices:

- Use the latest version: Ensure that you are using the latest version of the 4506-C form.

- Complete the form accurately: Ensure that the information provided on the form is accurate and complete.

- Submit the form promptly: Submit the form promptly to avoid delays in processing the request.

Conclusion

The 4506-C form is a crucial document that plays a significant role in verifying an individual's or business's income and employment history. By understanding the purpose and benefits of the form, individuals and businesses can ensure that they are using it effectively. Remember to complete the form accurately, submit it promptly, and follow best practices to avoid common challenges.

What's Next?

If you have any questions or concerns about the 4506-C form, please feel free to comment below. Share this article with others who may benefit from understanding the purpose and benefits of the 4506-C form. Take the first step towards unlocking the power of the 4506-C form and discover how it can impact your financial transactions.

What is the 4506-C form used for?

+The 4506-C form is used to request a transcript of an individual's or business's tax return from the IRS. The form is typically used by lenders, creditors, and government agencies to verify an applicant's income and employment history.

How do I complete the 4506-C form?

+Completing the 4506-C form requires basic information about the individual or business requesting the transcript. The form must be signed and dated, and it must include the name and address, Social Security number or EIN, tax year, and type of transcript being requested.

What are the benefits of using the 4506-C form?

+The 4506-C form provides several benefits, including verification of income, creditworthiness assessment, reduced risk, and a streamlined process for requesting and obtaining tax return transcripts.