Employee stock options can be a valuable benefit for employees, allowing them to purchase company stock at a discounted price. However, when it comes to reporting the income from these options, things can get complicated. That's where the 3949a tax form comes in – a crucial document for employees who have exercised their stock options. In this article, we'll delve into the world of employee stock options, explain the 3949a tax form, and provide guidance on how to navigate this complex topic.

Employee stock options are a type of equity compensation that allows employees to purchase company stock at a predetermined price, known as the exercise price or strike price. When an employee exercises their options, they are essentially buying the company stock at the exercise price and then selling it at the current market price, resulting in a gain. This gain is considered taxable income and must be reported to the IRS.

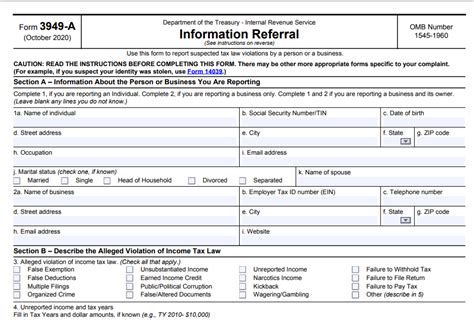

What is the 3949a Tax Form?

The 3949a tax form, also known as the "Employee Stock Purchase Plan Under Section 423(c) – Information" form, is used to report income from employee stock options. The form is typically provided by the employer to the employee and is used to report the income from the exercise of employee stock options. The 3949a form provides the necessary information for the employee to complete their tax return, including the number of shares exercised, the exercise price, the fair market value of the shares on the exercise date, and the gain or loss resulting from the exercise.

How to Complete the 3949a Tax Form

Completing the 3949a tax form may seem daunting, but it's a relatively straightforward process. Here's a step-by-step guide to help you navigate the form:

- Box 1: Date of Grant: This box shows the date when the employee stock options were granted.

- Box 2: Date of Exercise: This box shows the date when the employee exercised their stock options.

- Box 3: Number of Shares: This box shows the number of shares exercised.

- Box 4: Exercise Price: This box shows the exercise price per share.

- Box 5: Fair Market Value: This box shows the fair market value of the shares on the exercise date.

- Box 6: Gain or Loss: This box shows the gain or loss resulting from the exercise of the stock options.

Tax Implications of Employee Stock Options

When an employee exercises their stock options, the gain is considered taxable income and must be reported on their tax return. The gain is calculated by subtracting the exercise price from the fair market value of the shares on the exercise date. The gain is then reported as ordinary income on the employee's tax return.

For example, let's say an employee exercises 100 stock options with an exercise price of $10 per share. The fair market value of the shares on the exercise date is $20 per share. The gain would be $1,000 ($20 - $10 = $10 per share x 100 shares).

Types of Employee Stock Options

There are two main types of employee stock options: Non-Qualified Stock Options (NSOs) and Incentive Stock Options (ISOs).

- Non-Qualified Stock Options (NSOs): NSOs are the most common type of employee stock option. The gain from NSOs is considered ordinary income and is subject to income tax and employment taxes.

- Incentive Stock Options (ISOs): ISOs are a type of employee stock option that meets specific IRS requirements. The gain from ISOs is considered capital gain and is subject to capital gains tax.

Benefits of Employee Stock Options

Employee stock options can provide significant benefits to employees, including:

- Increased Wealth: Employee stock options can provide a significant source of wealth for employees, especially if the company's stock price increases over time.

- Motivation: Employee stock options can motivate employees to work harder and contribute to the company's success, as they have a direct stake in the company's performance.

- Retirement Savings: Employee stock options can be used as a retirement savings vehicle, providing employees with a source of funds for their retirement.

Common Mistakes to Avoid

When dealing with employee stock options, there are several common mistakes to avoid, including:

- Not reporting income: Failure to report income from employee stock options can result in penalties and interest.

- Not keeping records: Failing to keep accurate records of employee stock options can make it difficult to report income and claim deductions.

- Not seeking professional advice: Employee stock options can be complex, and seeking professional advice from a tax professional or financial advisor can help ensure that you are making the most of your options.

Conclusion

Employee stock options can be a valuable benefit for employees, but they can also be complex and confusing. The 3949a tax form is an essential document for employees who have exercised their stock options, providing the necessary information for tax reporting purposes. By understanding the 3949a tax form and the tax implications of employee stock options, employees can make informed decisions and maximize their benefits.

Frequently Asked Questions

What is the 3949a tax form?

+The 3949a tax form is used to report income from employee stock options.

How do I report income from employee stock options?

+Income from employee stock options is reported on the 3949a tax form and is considered ordinary income.

What are the benefits of employee stock options?

+Employee stock options can provide significant benefits, including increased wealth, motivation, and retirement savings.