Understanding the 199a Worksheet by Activity Form: A Step-by-Step Guide

The 199a Worksheet by Activity Form is a crucial document for businesses, especially those with multiple activities or entities, as it helps determine the qualified business income (QBI) deduction under Section 199A of the Internal Revenue Code. Filling out this form accurately is essential to ensure you're taking advantage of the deductions you're eligible for. Here's a comprehensive guide to help you complete the 199a Worksheet by Activity Form in four steps.

Step 1: Gather Necessary Information and Identify Business Activities

Before starting to fill out the 199a Worksheet, you need to gather all relevant financial information for each business activity. This includes:

- Gross receipts

- Cost of goods sold (COGS)

- Operating expenses

- Depreciation and amortization

Identify each business activity that qualifies for the QBI deduction. Ensure you understand the definitions of qualified business income (QBI) and qualified trade or business (QTB) as per the IRS guidelines. Your business activities might include:

- Retail or wholesale trade

- Manufacturing

- Real estate

- Professional services

Defining Business Activities

- Single Trade or Business: A single trade or business is considered a single activity. This could be a retail store or a professional services firm.

- Multiple Trades or Businesses: If you have multiple trades or businesses, you may need to aggregate them if they meet certain criteria, such as shared expenses or similar products/services.

Step 2: Calculate QBI for Each Activity

For each identified business activity, you'll need to calculate the qualified business income (QBI). The QBI is generally the net income from a qualified trade or business, but it excludes certain items, such as:

- Capital gains and losses

- Dividend income

- Interest income

- Calculate Net Income: Start with the gross income from each activity and subtract COGS, operating expenses, and any other deductions directly related to that activity.

- Adjust for Depreciation and Amortization: Adjust the net income for depreciation and amortization. This step might require careful consideration of how these expenses are allocated across different activities.

- Apply the QBI Limitations: If your business income is above the threshold amounts ($164,900 for single filers and $329,800 for joint filers in 2021), you may need to apply the QBI limitations, which involve reducing QBI based on wages and qualified property.

Step 3: Aggregate Business Activities (If Necessary)

If you have multiple business activities, you may need to aggregate them if they share common control, provide products or services that are customarily offered together, and meet other aggregation criteria as specified by the IRS.

- Determine Common Control: Determine if the activities are under common control, considering factors such as ownership and decision-making power.

- Assess Similar Products or Services: Evaluate if the activities provide products or services that are customarily offered together.

- Aggregate Financials: Combine the financial information (gross receipts, COGS, operating expenses) of the aggregated activities.

Step 4: Complete the 199a Worksheet and Calculate Total QBI Deduction

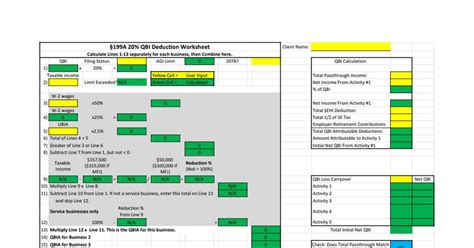

Using the calculated QBI for each activity (or aggregated activities), fill out the 199a Worksheet. You will calculate the total QBI deduction, taking into account any limitations and phase-outs based on your taxable income.

- Enter Business Information: Fill in the business name, taxpayer ID number, and other identifying information for each activity.

- Report QBI: Report the QBI calculated for each activity, including any adjustments for depreciation and amortization.

- Calculate Total QBI Deduction: Calculate the total QBI deduction, considering any aggregation and limitations.

By following these steps and carefully filling out the 199a Worksheet by Activity Form, you can accurately determine your qualified business income deduction and ensure compliance with the IRS regulations.

Final Thoughts on Accurate 199a Worksheet Completion

Completing the 199a Worksheet by Activity Form requires careful attention to detail and a thorough understanding of the IRS regulations. By accurately calculating QBI for each business activity and aggregating them as necessary, you can ensure you're taking full advantage of the QBI deduction available to your business.

If you're unsure about any aspect of the process, consulting with a tax professional or accountant can provide valuable guidance and help you navigate the complexities of Section 199A.

What is the 199a Worksheet by Activity Form used for?

+The 199a Worksheet by Activity Form is used to calculate the qualified business income (QBI) deduction under Section 199A of the Internal Revenue Code for businesses with multiple activities or entities.

What information is needed to complete the 199a Worksheet?

+To complete the 199a Worksheet, you'll need financial information for each business activity, including gross receipts, cost of goods sold (COGS), operating expenses, and depreciation and amortization.

How do I determine if business activities should be aggregated?

+Business activities should be aggregated if they are under common control, provide products or services that are customarily offered together, and meet other aggregation criteria as specified by the IRS.