Navigating the world of taxes and benefits can be a daunting task, especially when it comes to understanding the requirements of specific forms like the 1099 RRB. As an individual receiving railroad retirement benefits, it's essential to comprehend the ins and outs of this form to ensure you're meeting the necessary requirements and avoiding any potential penalties.

In this article, we'll delve into the world of the 1099 RRB form, exploring its purpose, benefits, and requirements. By the end of this guide, you'll have a solid understanding of what the 1099 RRB form entails and how to navigate its complexities.

What is the 1099 RRB Form?

The 1099 RRB form is a tax document used by the Railroad Retirement Board (RRB) to report railroad retirement benefits paid to recipients. This form is similar to the 1099 SSA form used by the Social Security Administration (SSA) to report social security benefits.

The 1099 RRB form is used to report various types of benefits, including:

- Railroad retirement annuities

- Lump-sum payments

- Supplemental annuities

- Medicare premiums

The RRB is required to provide a 1099 RRB form to each recipient by January 31st of each year, detailing the total benefits paid during the previous tax year.

Benefits of the 1099 RRB Form

While the 1099 RRB form may seem like just another tax document, it provides several benefits to recipients, including:

- Tax reporting: The 1099 RRB form helps recipients accurately report their railroad retirement benefits on their tax returns.

- Medicare premium information: The form provides information on Medicare premiums paid, which can be used to claim a deduction on tax returns.

- Lump-sum payment information: Recipients can use the form to report lump-sum payments received, which may be subject to income tax.

1099 RRB Form Requirements

To ensure compliance with tax laws, recipients must meet the following requirements when dealing with the 1099 RRB form:

- Reporting benefits: Recipients must report their railroad retirement benefits on their tax returns, using the information provided on the 1099 RRB form.

- Filing status: Recipients must file a tax return if their gross income exceeds the filing threshold for their filing status.

- Tax withholding: Recipients can choose to have federal income tax withheld from their benefits, which can help reduce their tax liability.

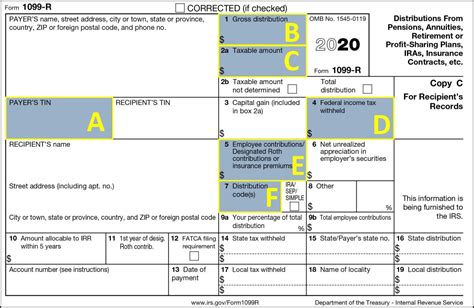

How to Read the 1099 RRB Form

The 1099 RRB form can seem daunting, but it's essential to understand what each box represents. Here's a breakdown of the most common boxes:

- Box 1: Gross Annuity Paid: The total amount of railroad retirement annuity paid during the tax year.

- Box 2: Medicare Premiums Paid: The total amount of Medicare premiums paid during the tax year.

- Box 3: Supplemental Annuity Paid: The total amount of supplemental annuity paid during the tax year.

- Box 4: Federal Income Tax Withheld: The total amount of federal income tax withheld from benefits during the tax year.

Common Errors to Avoid

When dealing with the 1099 RRB form, it's essential to avoid common errors that can lead to penalties and delays. Here are some common mistakes to watch out for:

- Incorrect reporting: Failing to report benefits or reporting incorrect amounts can lead to penalties and delays.

- Incorrect filing status: Failing to file a tax return or using the wrong filing status can lead to penalties and delays.

- Incorrect tax withholding: Failing to have sufficient tax withheld or not reporting tax withheld can lead to penalties and delays.

Conclusion

Navigating the complexities of the 1099 RRB form can be challenging, but with the right guidance, you can ensure compliance with tax laws and avoid potential penalties. By understanding the purpose, benefits, and requirements of the 1099 RRB form, you'll be better equipped to manage your railroad retirement benefits and make informed decisions about your tax obligations.

Don't hesitate to reach out to the Railroad Retirement Board or a tax professional if you have any questions or concerns about the 1099 RRB form. Stay informed, stay compliant, and ensure a smooth tax season.

What is the deadline for receiving the 1099 RRB form?

+The Railroad Retirement Board (RRB) is required to provide the 1099 RRB form to recipients by January 31st of each year.

Do I need to report my railroad retirement benefits on my tax return?

+Yes, you must report your railroad retirement benefits on your tax return. The 1099 RRB form provides the necessary information for reporting benefits.

Can I have federal income tax withheld from my benefits?

+Yes, you can choose to have federal income tax withheld from your benefits. This can help reduce your tax liability.