As a student or parent, navigating the world of tax forms can be overwhelming, especially when it comes to understanding the 1098-T form. The 1098-T form, also known as the Tuition Statement, is a crucial document that reports the tuition payments made to an eligible educational institution, such as the University of Texas Rio Grande Valley (UTRGV). In this article, we will delve into the world of 1098-T forms and provide you with 5 ways to understand and make the most out of this important document.

What is a 1098-T Form?

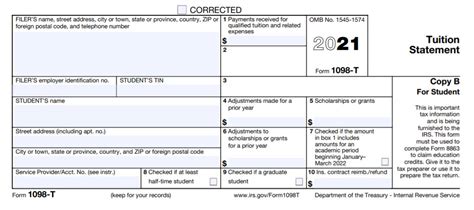

The 1098-T form is a tax document that colleges and universities are required to provide to their students and the Internal Revenue Service (IRS) each year. The form reports the amount of tuition and fees paid by the student during the tax year. This information is used to determine the student's eligibility for education tax credits, such as the American Opportunity Tax Credit and the Lifetime Learning Credit.

5 Ways to Understand Your 1098-T Form at UTRGV

1. Understanding the Different Sections of the Form

The 1098-T form is divided into several sections, each containing important information. The form includes:

- Box 1: The amount of tuition and fees paid by the student during the tax year.

- Box 2: The amount of scholarships and grants awarded to the student during the tax year.

- Box 3: The amount of room and board paid by the student during the tax year.

- Box 4: The amount of tuition and fees paid by the student for the upcoming tax year.

It is essential to understand what each section represents to accurately complete your tax return.

2. Distinguishing Between Qualifying and Non-Qualifying Expenses

Not all expenses reported on the 1098-T form qualify for education tax credits. Qualifying expenses include:

- Tuition and fees required for enrollment or attendance at an eligible educational institution.

- Course-related expenses, such as textbooks and supplies.

- Room and board expenses for students enrolled at least half-time.

Non-qualifying expenses include:

- Expenses related to personal or living expenses, such as transportation and entertainment.

- Expenses related to courses that are not required for the student's degree program.

It is crucial to differentiate between qualifying and non-qualifying expenses to ensure you receive the maximum education tax credit.

3. Understanding the Eligibility Criteria for Education Tax Credits

To be eligible for education tax credits, students must meet specific criteria, including:

- Being enrolled at least half-time in a degree program.

- Being a U.S. citizen or eligible non-citizen.

- Not having filed for bankruptcy.

- Not having been convicted of a felony.

It is essential to review the eligibility criteria to determine if you qualify for education tax credits.

4. Reporting 1098-T Form Information on Your Tax Return

When reporting 1098-T form information on your tax return, you will need to complete Form 8863, Education Credits. This form requires you to:

- Report the amount of tuition and fees paid by the student (Box 1).

- Report the amount of scholarships and grants awarded to the student (Box 2).

- Calculate the education tax credit based on the qualifying expenses.

Accurately reporting 1098-T form information on your tax return is critical to receiving the education tax credit.

5. Seeking Assistance from UTRGV or a Tax Professional

If you have questions or concerns about your 1098-T form or education tax credits, do not hesitate to seek assistance from UTRGV's Bursar's Office or a tax professional. They can provide guidance on:

- Interpreting the 1098-T form.

- Determining eligibility for education tax credits.

- Completing Form 8863.

Seeking assistance can ensure you accurately complete your tax return and receive the maximum education tax credit.

Conclusion

Understanding the 1098-T form is essential for students and parents to navigate the world of tax forms and education tax credits. By following these 5 ways to understand your 1098-T form at UTRGV, you can ensure accurate reporting and maximize your education tax credit.

Share Your Thoughts

Have you encountered any challenges when completing your 1098-T form or education tax credits? Share your experiences and ask questions in the comments below.

FAQ Section

What is the deadline for receiving my 1098-T form?

+The deadline for receiving your 1098-T form is January 31st of each year.

Can I claim education tax credits if I received a 1098-T form?

+Yes, you may be eligible to claim education tax credits if you received a 1098-T form and meet the eligibility criteria.

Where can I find more information about education tax credits?

+You can find more information about education tax credits on the IRS website or by consulting a tax professional.